Business

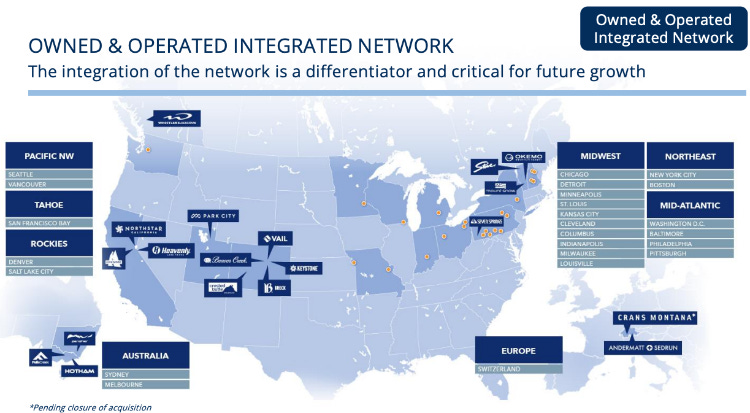

Vail Resorts (NYSE: MTN) operates ski resorts in North America(Mostly), Australia, and Europe. While mountains are public resources and cannot be owned by companies, infrastructures such as lifts, dining, lodging, transportation needs to be built and maintained. Vail Resorts own and operate 4 of the top 10 most-visited resorts. Annual skier visits are estimated to be 15.8 million for 2023-2024 ski season, YoY -8.1% from 17.2 million in prior year.

The company's main product is the annual ski season pass, which allows access to 39 ski resorts under Vail Resorts. This year's season pass is priced at $1,047. With different options and limitation, a day pass is looking at 119 USD. The idea is that if you are a often skier, A season pass would make a really good deal.

When I first came across the idea. I see the potential to operate resorts more efficiently and diversifiy risks from unfavorable weathers. I am also aware the posibility of over-selling the capacity. In theory you can go unlimited times, but in practice there are only so many holidays and good snow days.

I saw Youtube videos and commments about how expensive the season pass was and how packed the ski resorts were but I think this is also just a part of being destinations of a lot of people’s holiday.

Vail Resorts has resorts at major ski destinations across North America, people can buy a pass in advance and deciding later when and where exactly to ski. The flexibility is kind of a free lunch for both the consumers and the shareholders. The uncertainty of weather and trafic will always be there. Being able to have skiers commit to season passes early is like having insurrance from the weather. And the skiers gets discounts by providing this insurrance.

Financials

Vail Resorts' fiscal year runs from the end of July to the end of the following July. In the recently announced fiscal year 2024, the company reported a net profit of $230 million, down 14% from $268 million the previous year.

Adjusted Income Statement

I never liked the idea of company reporting adjusted earning numbers. However, I do like the idea of adjusting the income myself to have a better picture of profitabily of business I am investing in. After ignoring one-time items, we are looking at a company with 266m USD net income, 9.22% margin and effectively no growth.

Capex and Shareholder Returns

Capital expenditure has been roughly equal to depreciation, indicating maintenance of existing facilities without aggressive projects, which matches with the company's current no-growth state. In the 2023-2024 fiscal year, Vail Resorts distributed $323 million in dividends and repurchased $150 million in stock, totaling $473 million in shareholder returns. These numbers looks reasonable to me.

Valuation

2024/2025 North American ski season decreased approximately 2% in units and increased approximately 4% in sales dollars as compared to the period in the prior year. For the next fiscal year, management forecasts net profit between $224 million and $300 million.

There aren’t many things you can do to create more demands for skiing trips. I am quite positive to see the management focusing on improving operational efficiency to boost profits.

In September, the company announced plans to cut 14% of headquarters staff and 1% of operational staff over two years, saving about $100 million annually. Let’s say they achievehalf of that target, we are looking at a forward earning of around 300m USD.

Ski resort business has some natural monopoly nature and I don’t think it is likely that someone can just come and take away their business. I would think a forward PE around 20-25 is justifiable, corresponding to a market cap of 6-7.5b USD.