I was going through the list of the largest listed companies by market capitalization to look for a non-US large cap to invest in. Here’s one that’s interesting.

Business

EssilorLuxottica is a global leader in the eyewear and eye care industry. The company was formed in 2018 through the merger of Essilor (a French lens manufacturer) and Luxottica (an Italian eyewear frame and retail giant).

The Essilor part designs, manufactures, and markets ophthalmic lenses (for vision correction)

The Luxottica part designs, manufactures, and distributes eyeglass frames and sunglasses, it owns famous brands like Ray-Ban and Oakley.

It also operates optical retail chains and sunglass stores globally. Key banners include LensCrafters, Sunglass Hut, Pearle Vision, GrandVision (after acquisition), and Salmoiraghi & Viganò.

The company reports by two segments:

Direct to Consumer (DTC) – their retail businesses (LensCrafters, Sunglass Hut, Ray‑Ban stores, online platforms):

Revenue: ~€13.20 billion, representing 53 % of total revenue

Growth: up 7.1 % year-over-year at constant exchange rates

Professional Solutions (PS) – wholesale lenses & frames, optical labs, professional services:

Revenue: ~€11.30 billion, making up 47 % of group revenue

Growth: +4.7 % YoY at constant exchange rates

Total Group Revenue: ~€26.5 billion (+6.0 % at constant exchange rates), all-time high.

Breakdown of full-year 2024 sales by product:

Optical lenses & frames (prescription): ~75 % of revenue

Sunglasses: ~23 %

Apparel, footwear, accessories & smartglasses (Ray‑Ban Meta, Supreme, Nuance Audio, etc.): remainder (~2 %)

Financials

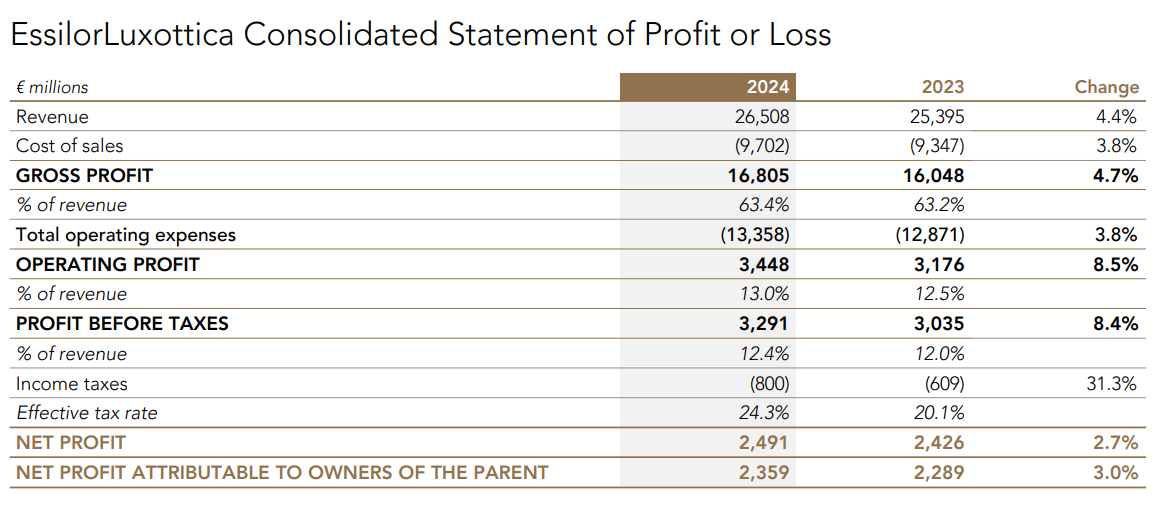

Income Statement

Gross Profit:

€16,805 million, rising +4.7% (gross margin 63.4%)

Operating Profit:

€3,448 million (≈13.0% of revenue), up 8.5% from €3,176 million (12.5%)

Net Profit:

€2,491 million (€2.35 billion attributable to owners), up ~2.7–3% YoY (Net margin ~9.4%)

Essilor Luxottica has a high gross margin but not a net income margin, indicating a lot of the cost went into SG&A, which I don’t like. Operating cost didn’t go to R&D . Essilor Luxottica’s 2024 operating expenses rose 3.8%—driven by €1 billion in acquisition-related amortization, inflation‑hit labor and business expansion, plus marketing, restructuring, and settlement costs—yet operating profit still climbed to 13.0% of revenue.

64% of the operating expenses went to selling, presumably physical store sales.

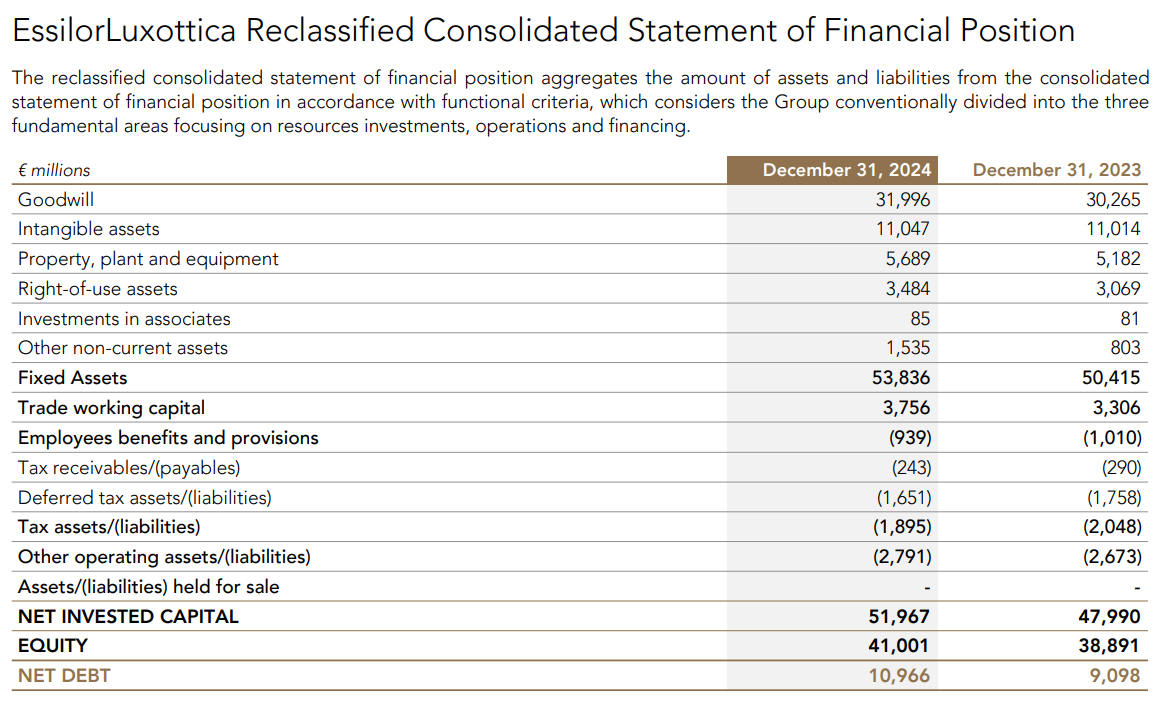

Balance Sheet

On paper, the company has a debt-to-equity ratio of 26%. However, over 80% of the Assets are Goodwill and intangibles. €10.9 billion of net debt cost the company €157 million or about 6.6% of the net profits. Interest cost is low, but it will take the company 4 years of net profits to pay off the net debt.

Cash flows

Cashflows are not particularly strong for Essilor Luxottica as it barely grew in 2024 and pretty much the were and net income. There were new issues of debts and significant capex.

Valuation

The nature of eyes care business could justify for higher valuation. However, after reading the annual report, it looks to me more like a premium item shop that relies heavily on retail sales operation. Even with the management’s adjusted net income of €3.2 billion, the stocks still trades at 35x PE. This is not cheap at all.